The Current State of the US Real Estate Market: A Deep Freeze?

The current market is shaped by unique factors. We observe record-low housing turnover, driven by a ‘rate-lock’ problem for many sellers. High mortgage rates and ongoing affordability concerns create significant challenges for buyers.

We will explore these trends in depth. We’ll examine the forces contributing to low inventory and buyer hesitation. We’ll also analyze how broader economic factors—like interest rates, inflation, and government policies—influence property values. Understanding your specific local conditions, such as those in the Detroit real estate market, is vital for making smart decisions. Our goal is to equip you with the knowledge needed to successfully rent, lease, or sell in today’s environment.

The US real estate market is currently experiencing a historically low level of activity, often described as a “deep freeze.” This stagnation is primarily characterized by a significant drop in housing turnover, a phenomenon with far-reaching implications for both buyers and sellers. The turnover rate for US homes has plummeted to its lowest level in at least 30 years, with approximately 28 out of every 1,000 homes changing hands in the first nine months of the year. This contrasts sharply with historical norms and indicates a significant slowdown in market fluidity.

This low turnover is not accidental; it’s a symptom of several interconnected issues. For sellers, the primary deterrent is the “rate-lock” problem, where homeowners are reluctant to part with their current properties due which often carry historically low mortgage rates. For buyers, the challenges are rooted in severe affordability constraints, exacerbated by high home prices, liftd mortgage rates, and, for some, concerns about job market stability. These factors collectively contribute to a market where both supply and demand are suppressed, leading to fewer transactions and a less dynamic environment.

The Seller’s ‘Golden Handcuffs’

A significant driver of the current low housing turnover is what industry experts refer to as the “rate-lock” problem. This phenomenon describes homeowners who secured mortgages during periods of historically low interest rates—particularly when rates were below 5%. With current mortgage rates hovering significantly higher, these homeowners find themselves in “golden handcuffs.” Over 70% of mortgage borrowers in the US have financed their homes at a rate below 5%. Selling their current home would mean forfeiting these advantageous rates and taking on a new mortgage at a much higher cost, potentially doubling their monthly payments for a similar-priced property.

This reluctance to sell directly contributes to a severe inventory shortage. When homeowners are disincentivized to move, fewer properties come onto the market. This scarcity, in turn, keeps home prices liftd, further complicating the situation for potential buyers. The historical context of this situation is crucial; the era of ultra-low interest rates following the 2008 financial crisis allowed millions to lock in favorable terms, creating a powerful disincentive to move in today’s higher-rate environment.

The Buyer’s Uphill Battle

While sellers are constrained by their low mortgage rates, buyers face their own set of formidable challenges. The most prominent among these is the escalating cost of homeownership. High home prices, combined with liftd mortgage rates, have pushed affordability to critical lows. Mortgage rates directly impact the monthly cost of a home, and even small increases can significantly reduce purchasing power. This makes it challenging for many prospective buyers, especially first-time homebuyers, to qualify for loans or to afford the monthly payments.

The affordability index, which measures how many households can afford a median-priced home, has been trending downwards. This means a smaller percentage of the population can comfortably afford to buy a home. Furthermore, the requirement for substantial down payments continues to be a barrier, particularly for younger generations who may not have accumulated significant savings. Economic uncertainty, including concerns about the job market and potential recessions, also makes buyers more cautious, leading them to postpone major financial commitments like purchasing a home.

Economic Headwinds: How Interest Rates, Inflation, and Policy Shape the Market

The real estate market is intrinsically linked to broader economic conditions. Interest rates, inflation, overall economic health (measured by GDP and employment rates), and government policies all play pivotal roles in shaping property values and demand. Understanding these relationships is crucial for predicting market movements and making informed decisions.

Interest rates, particularly mortgage rates, have a direct and immediate impact on real estate demand and property prices. When interest rates rise, the cost of borrowing increases, making mortgages more expensive. This reduces buyer affordability and can lead to a decrease in demand, potentially softening home prices. Conversely, falling rates can stimulate demand and drive prices up.

Overall economic health, indicated by a strong Gross Domestic Product (GDP) and low employment rates, generally supports a robust real estate market. A thriving economy means more jobs, higher incomes, and greater consumer confidence, all of which fuel housing demand. Conversely, economic downturns can lead to job losses, reduced purchasing power, and a decline in real estate values.

Government policies, such as tax credits for homebuyers or subsidies for affordable housing, can temporarily boost or suppress real estate demand. These interventions aim to address specific market needs or stimulate economic activity, but their effects can be transient. Inflation, too, has a complex relationship with real estate, influencing construction costs, property values, and rental rates.

Interest Rates and Inflation

The Federal Reserve’s monetary policy, particularly its decisions on interest rates, acts as a powerful lever on the real estate market. When the Federal Reserve raises its benchmark interest rate, it typically leads to an increase in mortgage rates. This makes home loans more expensive, reducing the purchasing power of buyers and dampening demand. As demand cools, property price growth can slow down or even decline. Conversely, lower interest rates make mortgages more affordable, stimulating demand and often leading to an appreciation in home values.

Inflation also significantly impacts the real estate market. Rising inflation means that the cost of goods and services is increasing. For real estate, this translates to higher construction costs, including materials (lumber, steel, etc.) and labor. These increased costs can limit new supply, as developers face higher expenses, and existing homes become more valuable in comparison. If demand remains strong amidst limited supply, inflation can put upward pressure on property prices. However, if inflation erodes purchasing power and leads to higher interest rates, it can also deter buyers, creating a more complex scenario. The interplay between these factors can create volatile market conditions, requiring careful monitoring by all market participants.

Government and Economic Health

The broader economic landscape, characterized by Gross Domestic Product (GDP) growth and employment rates, forms the bedrock of real estate market stability. A robust GDP indicates a healthy economy, which typically translates to job creation and rising incomes. This economic buoyancy boosts consumer confidence, making individuals more likely to invest in homeownership. High employment rates mean more people have stable incomes, increasing their capacity to afford mortgage payments and contributing to sustained housing demand.

Government policies also play a crucial role, often acting as direct interventions to shape market dynamics. Policies such as first-time homebuyer tax credits or housing subsidies can temporarily stimulate demand by making homeownership more accessible or affordable. For instance, a first-time homebuyer tax credit can encourage individuals to enter the market, leading to a temporary surge in sales. However, the impact of such policies can be short-lived, and their withdrawal can lead to a dip in demand. Understanding these macroeconomic indicators and policy influences is essential for anyone looking to analyze or participate in the real estate market, whether it’s the national scene or analyzing local trends in the Detroit real estate market.

Regional Variations and Long-Term Demographic Trends

While national trends provide a broad overview, the real estate market is inherently local, exhibiting significant regional variations. Migration patterns play a critical role in shaping demand and supply in specific metropolitan areas and states. Furthermore, long-term demographic shifts, such as the aging of the baby boomer generation, are continuously influencing housing needs and demand across the country.

Current US migration trends reveal a dynamic movement of people, with some states and metropolitan areas experiencing substantial inbound migration, while others see an exodus. Nationwide, 29% of homebuyers searched to move to a different metro area between June ’25 and August ’25. The top 5 states homebuyers searched to move to were Florida, Arizona, North Carolina, Tennessee, and South Carolina, indicating a preference for warmer climates or areas with lower costs of living. Conversely, California, New York, Illinois, Maryland, and Washington were the top 5 states homebuyers searched to move from, often driven by high housing costs and taxes. These movements directly impact local housing markets, increasing demand and prices in destination areas and potentially easing pressure in origin regions.

Hot Spots and Cool Downs: A Geographic Snapshot

The impact of low housing turnover is not uniform across the United States. Some major metropolitan areas are experiencing significantly lower turnover rates than the national average, indicating a more “frozen” market. For example, New York City recorded just 10.3 sales for every 1,000 homes in the first nine months of the year, making it one of the areas with the lowest housing turnover. Other urban centers like Los Angeles and San Francisco also show fewer than 15 sales per 1,000 homes year-to-date, reflecting similar challenges. These areas often combine high property values with a significant percentage of homeowners locked into low mortgage rates, exacerbating the supply shortage.

To illustrate regional variations, let’s consider the Maryland market as a case study. In September 2025, home prices in Maryland were up 1.2% year-over-year, with the median sale price reaching $437,800. The number of homes sold rose by 1.8% in September, while the number of homes for sale saw a more substantial increase of 21.0%. The median days on market was 42 days, indicating a relatively steady pace. Competition levels varied: 31.2% of homes sold above list price, suggesting some competitive bidding, yet 32.2% of homes also experienced price drops, indicating a market where buyers have some leverage. Maryland was also among the top 5 states homebuyers searched to move from, highlighting a complex interplay of local and national factors. These granular details emphasize the importance of understanding specific local conditions rather than relying solely on national averages.

The Demographic Wave

Beyond current economic fluctuations, long-term demographic shifts are fundamentally reshaping the real estate landscape. The aging of the baby boomer generation (born between 1945 and 1964) is one of the most significant influences. As this large cohort moves into retirement, their housing needs and preferences are evolving, impacting demand for various property types. Many baby boomers are considering downsizing from larger family homes to smaller, more manageable properties, or moving to age-restricted communities. This trend could eventually release a significant amount of existing housing inventory onto the market, potentially easing supply constraints in certain areas.

Furthermore, some baby boomers are seeking second homes in vacation areas, while others may opt for urban living, driving demand in specific niches. The increasing longevity of this generation also means they might occupy their homes for longer periods, further contributing to the low turnover in some segments. These shifts will inevitably influence long-term real estate trends, from the types of homes being built to the amenities in demand. Understanding these demographic waves is crucial for investors and developers, particularly in dynamic urban centers like the River North real estate market, where demand for diverse housing options continues to evolve.

Strategic Moves for Sellers, Buyers, and Investors

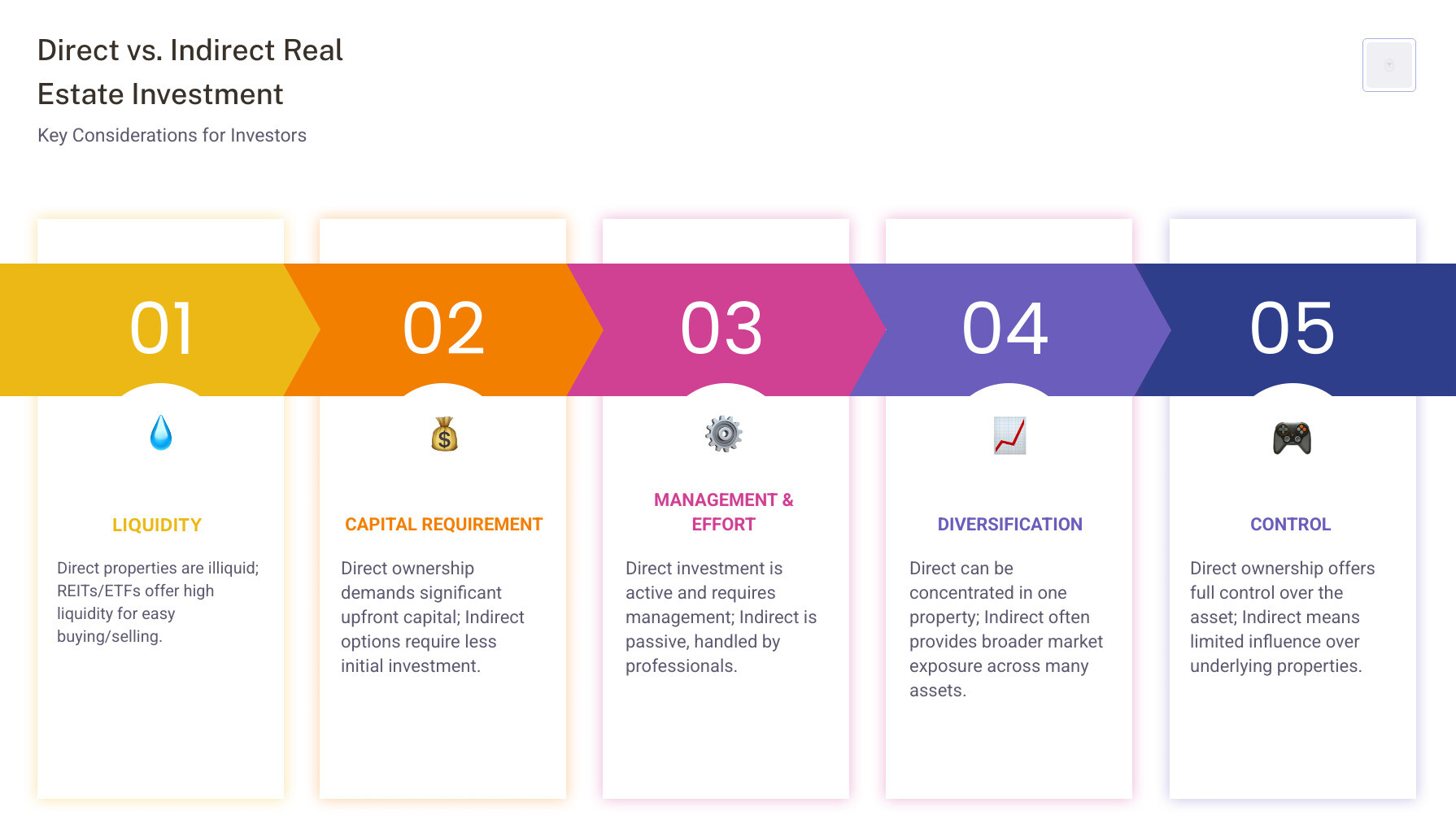

Navigating the current real estate market requires a strategic approach, whether you are selling, buying, or investing. Given the low turnover, high interest rates, and fluctuating regional conditions, understanding your options and leveraging available resources is paramount. For sellers, competitive pricing and strategic incentives are key. Buyers need meticulous financial preparation and a clear understanding of market dynamics. Investors, meanwhile, must weigh the benefits and risks of direct property ownership versus indirect investment vehicles like Real Estate Investment Trusts (REITs) or Exchange-Traded Funds (ETFs).

In a market where competition can still be fierce in some segments while price drops are common in others, successful outcomes hinge on informed decision-making. We must consider how to best position a property for sale, how to make a competitive offer as a buyer, and where to find the most promising investment opportunities.

A Seller’s Guide to the New Normal

For sellers in today’s market, the “new normal” means adjusting expectations and adopting flexible strategies. With many buyers facing affordability challenges and higher mortgage rates, simply listing a home at a premium price may not yield the desired results. Understanding the true market value of your home, based on recent comparable sales and current demand, is the first critical step. Overpricing can lead to longer days on market and eventual price reductions, which can deter potential buyers.

Sellers may need to consider offering incentives to attract buyers. This could include covering some closing costs, offering a rate buy-down to lower the buyer’s initial mortgage payments, or even making minor repairs or upgrades to improve the home’s appeal. In a market that is becoming more balanced, sellers who are willing to negotiate and be flexible often have greater success. Partnering with a knowledgeable real estate professional can provide invaluable expertise in the real estate market for a smooth transaction, helping to steer pricing strategies, marketing, and negotiations to achieve the best possible outcome.

Strategic Decisions for Buyers in the Current Real Estate Market

Buyers in the current real estate market face a unique set of challenges, but also potential opportunities. Financial preparation is more crucial than ever. This includes not only saving for a substantial down payment but also budgeting for current mortgage rates, which may be significantly higher than historical lows. Understanding how interest rates impact your monthly payments and overall affordability is essential for setting realistic expectations.

Furthermore, recent changes in the real estate industry, particularly regarding agent commissions, mean that buyers need to be more proactive in understanding and negotiating these costs upfront. Transparency in commission structures allows buyers to make more informed decisions and potentially save money. For first-time homebuyers, exploring down payment assistance programs and understanding the long-term financial implications of homeownership are vital. Planning to stay in a home for a longer duration can help mitigate the impact of short-term market fluctuations and allow for equity appreciation.

Understanding Investment in the Real Estate Market

For those looking to invest in real estate, the current market presents a diverse landscape of options, each with its own advantages and disadvantages. Direct property ownership, such as purchasing a rental home or commercial property, offers control and potential for significant capital appreciation and rental income. However, it typically requires substantial capital, involves ongoing management responsibilities, and can be illiquid, meaning it’s not always easy to sell quickly.

Alternatively, indirect real estate investment offers greater liquidity and lower capital requirements. Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate. Investing in REITs allows individuals to own a share of commercial real estate portfolios, receive dividends, and trade shares on stock exchanges, similar to stocks. Real estate ETFs (Exchange-Traded Funds) provide diversification across various real estate sectors or regions, offering broad market exposure without direct property management. These indirect methods are often preferred by average investors due to their ease of entry, diversification benefits, and lower transaction costs, providing a way to participate in the real estate market without the complexities of direct ownership.

Frequently Asked Questions about the Real Estate Market

What are the key factors that influence a property’s value?

Several key factors collectively determine a property’s value. Location is often paramount, encompassing everything from neighborhood amenities, school districts, and proximity to jobs and transportation. Comparable sales (comps) in the immediate area provide a benchmark for pricing, reflecting what similar properties have recently sold for. The condition, age, and size of the property also play a significant role, with newer, well-maintained, and larger homes typically commanding higher prices. Finally, the overall health of the housing market, including supply and demand dynamics, interest rates, and economic stability, significantly impacts property values.

What is considered the biggest threat to the real estate industry?

According to experts, the biggest threat to the real estate industry is a weakening economy or a recession. Such economic downturns can lead to widespread job losses and a decrease in household incomes, which directly impacts people’s ability to afford housing. This reduction in purchasing power can squelch demand for both buying and renting, leading to declining property values and increased mortgage defaults. A prolonged economic slump can create a domino effect, affecting everything from new construction to investment returns across the entire real estate sector.

How does inflation specifically impact property prices?

Inflation impacts property prices in several ways. Firstly, it leads to increased construction costs, as the price of building materials (lumber, steel, concrete) and labor rises. This makes new construction more expensive, which can limit the supply of new homes. When new supply is constrained but demand persists, it creates upward pressure on the values of existing homes. Secondly, inflation can also lead to higher rental rates, as landlords seek to offset their increased operating costs. This, in turn, can make homeownership seem more appealing as a hedge against rising rents, further supporting property prices. However, if inflation is accompanied by high interest rates, it can also reduce affordability, creating a complex and sometimes contradictory effect on the market.

Conclusion

Navigating today’s real estate market, whether you’re renting, leasing, or selling, demands a nuanced understanding of its complex dynamics. We’ve seen that the US market is currently characterized by historically low housing turnover, largely due to the “rate-lock” problem for sellers and significant affordability challenges for buyers. Broader economic forces, including interest rates, inflation, and government policies, exert powerful influences on property values and demand.

For sellers, the key takeaways involve realistic pricing, considering incentives, and seeking professional guidance to stand out in a discerning market. Buyers must prioritize financial preparation, understand current mortgage rate impacts, and be aware of evolving commission structures. Investors have a spectrum of choices, from direct property ownership with its higher risks and rewards to indirect methods like REITs and ETFs that offer liquidity and diversification.

The market is not monolithic; regional variations, like those seen in Maryland, and long-term demographic shifts, such as the aging of the baby boomer generation, add layers of complexity. While challenges persist, an informed and strategic approach allows individuals to adapt and make sound decisions. The real estate landscape is changing, and staying abreast of these trends is crucial for successful participation.